Introduction

I have been investing for a long time. Although I have never had a lot of money to invest and I have not become a multi-millionaire, I have learned some lessons and made plenty of mistakes.

There are many myths and misunderstandings about investing so I wanted to investigate some data to see what the best long-term strategy could be and what the real risks are.

Note, we are only talking about long-term investment here. For example, a savings plan for retirement or similar objectives. Short term investing (day trading, options, etc) is a completely different story with completely different risks and strategies.

Data Sources and Standardisation

Three types of assets are studied: Stock returns, property and gold. Other investment types exist (notably bonds) but these are the most accessible for most people.

For stock returns, I compare three markets – USA, Switzerland and New Zealand. The major stock market index is used in all cases (S&P 500, Swiss Performance Index, NZX 50). Most studies focus on US stock market returns. Other stock markets may appear more volatile or less rewarding, so it is interesting to compare.

For property, I use Switzerland (very stable market) and New Zealand as an example of a country where property is considered a safe and productive investment.

Finally, gold is considered the ‘gold standard’ for investment assets.

To compare the returns from each asset class, we need to take care of three things:

- Total Returns. Stock returns include not just the increase in price of the stock but also the dividends that are payed to stockholders. If these dividends are re-invested, then the value further increases. To take this into account, ‘total return’ stock indexes are used (TR).

- Currency Standardisation. Assets are priced in the local currency and exchange rates vary over time. I have converted all prices to Swiss francs (CHF) to standardise. A better approach might be trade-weighted exchange indexes, but these are not readily available for long time periods in all currencies. The CHF has been, over many decades, the world’s most stable currency.

- Inflation. In order to calculate ‘real returns’ after removing inflation, all prices are adjusted for the consumer price index (CPI).

Initial Results

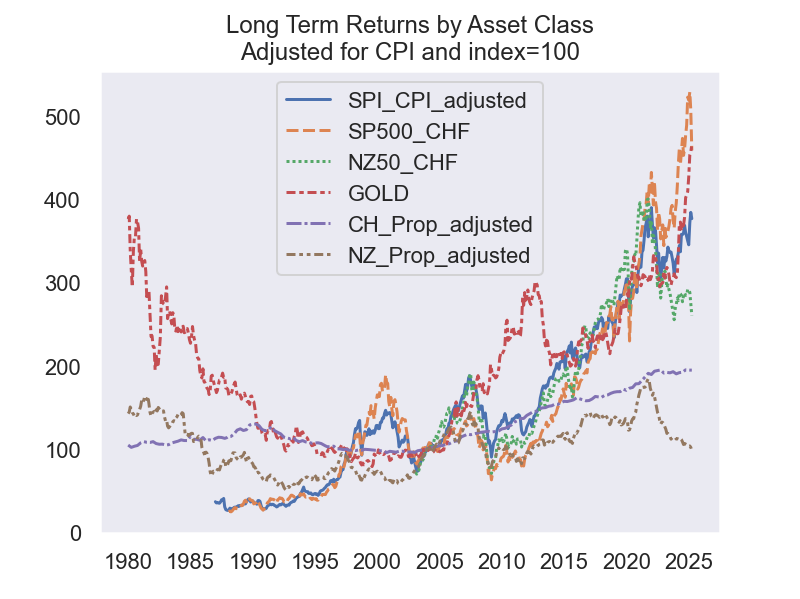

The inflation-adjusted, currency standardised returns are shown in the chart below.

The indexes are all normalised to 100 at year 2004. This means that we are comparing something that was valued at 100 CHF in the year 2004, compared with other assets and time periods. For example 100 CHF worth of gold in 2004 was valued at 168 CHF in 2008. It was also valued at 170 CHF in 1988, meaning that it made no gains at all, in real terms, from 1988 to 2004.

We can see that the different asset classes behave differently over the long term.

- Stock indexes generally increase, but they can also have big declines in value. Stocks have increased in value by around 4x in the last 20 years.

- Property indexes have relatively low returns and can also lose value, sometimes over quite long periods of time.

- Gold has increased and decreased over time and is now back to levels (inflation adjusted) similar to 1980.

Stock Indexes

A stock index is a calculation of the weighted average value of stocks traded on the stock exchange. For example, the S&P 500 looks at the latest price of the top 500 stocks in the US, and weights them by the total market value of each stock (how much it would cost to buy the entire company). Large companies are weighted more heavily so that, for example, if Microsoft (currently 2nd on the list) loses 10% of its value then this may have a noticeable impact on the S&P 500 but if Domino’s Pizza (431 on the list) loses value then there is no impact. As the value of companies increases or decreases, their position in the index automatically changes.

Since the 1990s, it has been possible to invest directly in a stock index by purchasing a single asset – an Exchange Traded Fund (ETF). Studies have shown that ETFs consistently out-perform most human fund managers who are trying to maximise returns by picking stocks. Investing in an ETF is a simple and effective way to invest in the stock market without needing to pick which stocks to buy.

Over time, stock prices rise and fall. But over the long term, they generally rise. Some investors try to pick the right time to invest, but they can be wrong and lose money in the short term. The analysis of the data shows that the length of the investment is much more important that the timing.

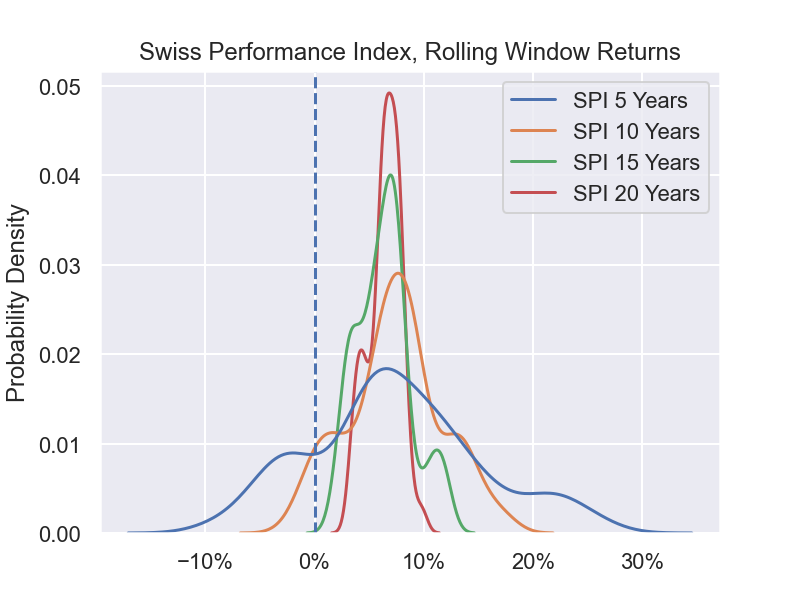

To show this, I calculate the investment returns for ‘rolling windows’ of 5, 10, 15 and 20 years. A rolling window is a period of time (for example 5 years) starting at every possible month in the data. For example, I look at the returns on a 5 year investment starting in January 1990, February 1990, March 1990, all the way to December 2019. Some of these windows will have a negative return, some will be positive, and by comparing them all, we can find the probability distribution of returns on a multi-year investment. The returns are then annualised to show the average annual compound rate that would generate the 5, 10, 15 or 20 year return. The chart below shows the probability distribution of returns for the Swiss stock market.

One can see that there is a significant risk of losing money on a 5 year investment window (20% chance), even though their is a chance to make returns up to 27%. For a 15 or 20 year investment window, the risk of losing money is zero.

For all investment windows, the mean and median annual returns are around 6-7%. This is a doubling of value in around 12 years! Remember that this is after inflation is taken into account.

The results are similar for the NZ stock market and for the US stock market. All over the world, stocks are a reliable investment that will generate positive returns over the long run.

However, this is not necessarily true for all markets. Investors have lost money in recent years by investing in “emerging markets” where the returns are potentially much greater, but so are the losses.

Property as an Investment

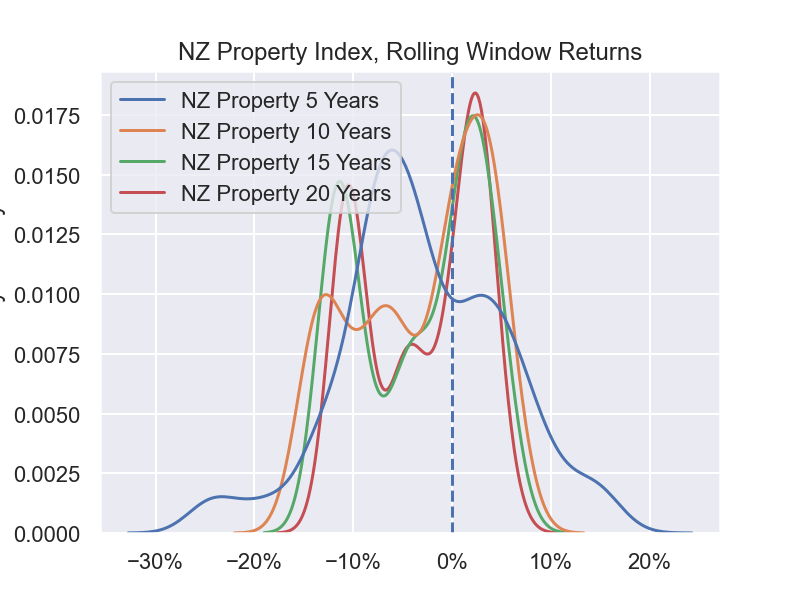

Property indexes are calculated by most government statistical agencies. I have compared property prices for Switzerland and New Zealand.

In New Zealand, in particular, property is considered a safe investment. People borrow as much as possible to buy a home, on the assumption that prices will always rise and they need to get on the escalator as soon as possible.

Note that the property index here is adjusted for inflation and for the declining value of the NZ dollar. We are comparing NZ property with other global investments, which may not be relevant for a family in NZ who want to buy a home.

Property is not a great investment. If one considers the additional costs of taxes, mortgage payments and maintenance, property will not return profits. Home owners see the value of their property increase in nominal terms (dollars), but they do often consider the impact of inflation and other costs.

There are two reasons to buy property:

- You need a home. In this case, go ahead and buy a house if you think the total costs are significantly better than renting. Look at all of the maintenance costs, taxes and mortgage payments compared to a simple rental contract. Don’t forget transaction costs (fees for buying or selling).

- You want to be a landlord. Here, the calculation is the opposite. If the rental income can compensate for taxes, mortgage interest and the value of your own time, then rental property can be an interesting investment and lifestyle.

Gold as an Investment

The “gold standard” is a terrible investment. It’s price is driven by political factors and it does not return any dividends or other profits.

Until 1973, gold was the global standard for international exchange, under the “Bretton Woods” system where the value of the US dollar was fixed at $35 per ounce of gold and all other currencies were fixed to the dollar at agreed rates of exchange. In 1973, the US unilaterally abandoned the gold standard and gold was free to find its market price. After reaching a high of $750 in 1980, it declined to around $400 and stayed there for 25 years. It is only since the financial crisis of 2007 that gold has become a safe-haven asset and demand has pushed prices up.

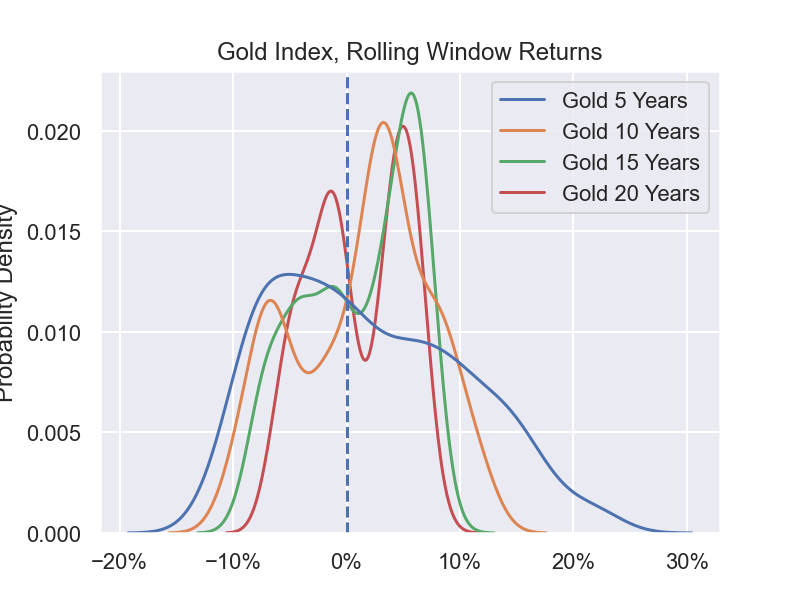

The chart below shows the probability distribution of investments in gold for different rolling time windows:

The average return is always below 2%. For a 10-year investment, returns are negative in around 36% of time windows.

In times of political uncertainty, demand for gold increases and pushes up the price. A speculator can make money by timing these events correctly. But for normal investors, gold is usually a terrible investment.

What about Bitcoin?

Bitcoin was started in 2009. For a long time it was a speculative asset, and some people made a lot of money. There was a speculative boom from 2020 to 2022 during which the price increased 5x and then declined again. In 2024, the US authorities allowed ETFs on bitcoin to be traded directly on the stock exchange. At this time, bitcoin became an investment asset, and the price increased again 5x as investment funds bought the asset. Nothing can go up forever, so it is an open question whether bitcoin will remain around $100,000 or whether it can reach $1M. Of course the speculators would like you to believe the latter.

Parallels with Gold. Like gold, bitcoin has no intrinsic value. (gold can be used for jewellery and electronics, but if that were its only use it would be valued more like other metals). They do not generate dividends or wealth (like stocks or bonds) and they are mainly used as a store of value. Investors get gains if the prices rise, which happens if demand from future investors increases. The total value of all investment gold is currently $26T and bitcoin is $2.2T – a factor of 10x which may represent the theoretical limit for bitcoin. Most of the gold in the world is owned by governments or central banks whereas bitcoin is not yet a reserve asset.

There are possible future developments which could make bitcoin a reserve asset like gold (https://www.dw.com/en/bitcoin-as-a-us-strategic-reserve-does-it-make-sense/a-71837690). If this happens, bitcoin could again increase by 10x. Or it might not… It’s also possible that a major scandal, security breach or criminal activity could see investors dump their bitcoin and the price could go to zero.

Perhaps the safest way to view bitcoin is like gold in 1980. It has become an investment asset since 2024, which has driven up the price quickly, and it will remain around that level for the long-term future unless there is another, unpredictable, shock to the system.

Why not Bonds?

Bonds are one of the original investment assets. They are very simple to understand since they are effectively just a debt that pays fixed interest for a fixed period – just like the classic bank term deposits. Lending money to governments by purchasing bonds was a route to enormous wealth for certain families in the 19th century and was considered a safe investment for many people in the early 20th century.

However, the bond market has become too efficient and market interest rates have made bonds less attractive. The price of a bond (on the market, not the issue price) is determined by interest rates which in most mature markets have been very low for the last 20 years. Bonds may increase in value as interest rates fall – so they can be a speculative asset that may generate profits. But for most people they barely hedge against inflation.

As part of an investment portfolio, bonds may be interesting as an inflation-protected base or to generate a small income, but they are unlikely, in the current market conditions, to generate significant profits.

Some Simple Lessons

- Invest for the long term. Most investments can lose money in the short term, and usually do. To reduce the risk of loss, invest for as long as possible – at least 10 years. Don’t even think about buying investments if you think you might need the money in 3 years.

- Invest in stock indexes. Picking stocks is gambling. Picking niche funds or fund managers is gambling. Stock indexes automatically adjust the selection of stocks and ensure that you get the average return, which is always positive in the long run. Individual stocks can become worthless very quickly and never recover.

- Reducing debt is often more productive than investing. If you must buy your own house, invest first in reducing your debt before you buy other assets.

- Set up a savings plan. Putting aside a fixed amount every month is a much more disciplined strategy than just investing when you happen to have a surplus. And purchasing investment assets every month means you reduce the risk of exposure to the market price at one point in time.

But I want to get rich quick

Okay. I get it. Other people are rich, so why not me?

People get rich in different ways. The best way to do it is to create something that creates significant value (a company, a new invention, pet rocks). There are also illegal or immoral ways (stealing, bribery, …). Some people get rich by investing.

There are often bubbles in the market. If you see a bubble and feel confident in the reasons for the bubble, you can try to take the opportunity.

I have correctly judged 3 bubbles in the last 15 years: Apple, Tesla and Bitcoin. In all 3 cases, the value increased by around 10x and I wished I had trusted my instinct and invested more. Sounds easy, but there are some common mistakes to avoid:

- Buy too late. Gold has just had a big increase in the last few years. Time to buy? NO! You just missed the escalator and there isn’t another one coming.

- Sell too early. I’ve doubled my money, time to get out. Nope. Unless you really think the bubble may burst (and they do) then hold for as long as possible. A 2x return is great, but that’s when other people start buying and 10x is much nicer.

- Testing the water. If you want to make money, you need to put money in. You can ride an escalator with $1000 but you won’t be retiring early if it reaches $10,000. You need to start with $10,000 or more, and if you can’t risk losing all of that they you aren’t a speculator.